Here's Why You Should (Almost) Never Finance a Smartphone

A 0% APR offer may seem enticing, but you'll be paying for that cheap financing in other ways.

Smartphones, especially top-of-the-line models from Apple or Samsung, are expensive. An iPhone 15 Pro starts at $999, and it will cost you hundreds of dollars more for a reasonable amount of storage.

It's no wonder, then, that many consumers take advantage of smartphone financing offers. Phone manufacturers like Apple offer their own financing plans, as do the major carriers. In some cases, these financing offers come with 0% interest as long as you pay off the phone in the allotted time.

Some will argue that there's no downside to financing a smartphone if you can get 0% financing, but this simply isn't true. Here's why.

Spending more than you can afford

A $999 iPhone 15 seems a lot more affordable if you break down the cost into 24 monthly payments of $41.62. That's the deal you can get directly from Apple. While it may make financial sense to accept this 0% interest offer, financing your smartphone can lead you to spend more money than you otherwise would. Apple doesn't offer financing out of the kindness of its cold, dead corporate heart. It offers financing because the suits in Cupertino understand human psychology.

Here's a simple rule to follow: If you can't afford to buy a phone outright, then you can't afford the phone. Period. Financing something you can't afford doesn't make it any more affordable, and it puts you in a position where you're always paying off something.

If the cost of a brand-new iPhone is too high, there are less expensive alternatives. Apple's iPhone SE, a perfectly capable device with a snappy processor and all the features most people need, can be bought directly from Apple for $429. On the Android side, there are a host of affordable options, including Google's Pixel phones, the OnePlus Nord N30, and lower-end Samsung Galaxy devices.

If you're dead set on always buying the latest model, you can plan on keeping your phone for longer. Paying $999 upfront for a phone that you use for four years is a lot more reasonable than upgrading after two years.

Locked into an overpriced wireless plan

One benefit of financing directly through Apple is that you're free to switch wireless plans at any time. If you finance through a wireless carrier, you're stuck until you pay off your phone.

This wouldn't be a huge problem if the standard postpaid wireless plans available for those who finance their phones were reasonably priced. However, they are not. If you're paying for a single line, the cheapest Verizon plan is $65 per month. The per-line price drops to $30 with four lines, but now you've made it even harder to switch providers since you need to pay off all four phones, or switch them piecemeal and eat the higher per-line pricing.

By financing your phone through a major carrier, you deprive yourself of options. Visible, a Verizon-owned prepaid wireless service, offers capable unlimited plans for $25 per line regardless of how many lines you need on the same Verizon network you know and love. If it's just you, you can save $40 per month by switching from Verizon to Visible. That's nearly as much as the entire payment on a $999 iPhone 15 Pro.

Even if you can score a deal from Verizon or another major carrier that reduces the cost of the smartphone, you're still locked into an overpriced plan for years. For customers who qualify, Verizon currently offers the iPhone 15 Pro for $10 per month for 36 months, allowing you to save $640 on the cost of the phone. However, you'll be trapped overpaying for your wireless plan for the same amount of time.

Here's how the costs break down for a solo smartphone user:

- If you take advantage of Verizon's deal for the iPhone 15 Pro, you'll pay $10 per month for the phone and $65 per month for Verizon's cheapest plan. Over three years, you'll pay a total of $2,700.

- If you buy the iPhone 15 Pro outright for $999 and opt for Visible's $25 monthly plan, you'll pay a total of $1,899 over the same three-year period.

Avoiding Verizon's financing trap will save you about $800 over three years.

Once you start buying your smartphones outright and taste the freedom of being able to switch your wireless plan at any time, you'll wonder why you didn't do it sooner.

Do you know where your money goes?

Most people don't even realize they're overspending on thier wireless plan because they have no idea where they're money is going. It's not thier fault — the cost of everything is going up, and it's easy to lose track of subscriptions and recurring expenses.

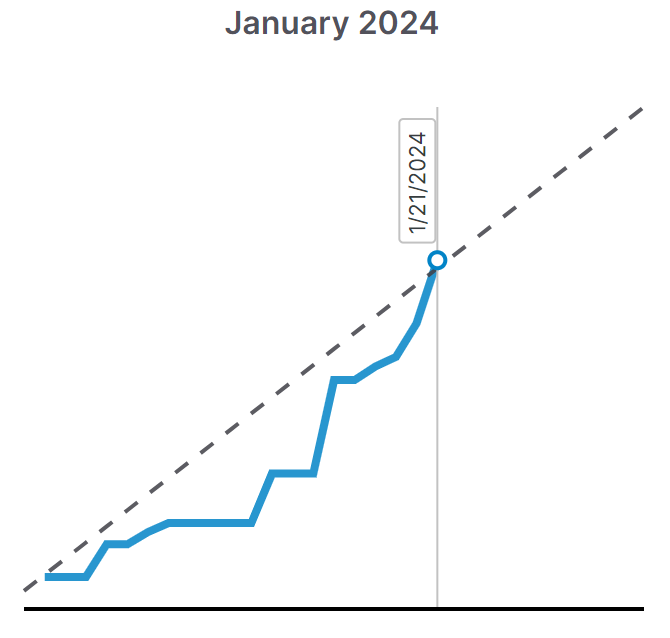

If you've struggled with keeping tabs on your spending in the past, Latwy might be the perfect solution. Real-time alerts, delivered seconds after swiping your card via email, Telegram, Discord, or Slack, can help you get a handle on where your money goes each month.

You can try Latwy free for 30 days with no credit card required. Discover the benefits of Latwy.