This Is the Only Book About Saving Money You’ll Ever Need

A book written a century ago about life thousands of years ago offers more insight than any mainstream personal finance book.

Go to amazon.com and search for how to save money book, and you'll be presented with an endless list of popular titles from an equally endless list of so-called gurus. You'll find all sorts of systems, methods, and techniques. Some of them may work for some people. Others either don't work at all or aren't sustainable.

A good example of a book that probably isn't worth your time is The No-Spend Challenge Guide. The idea here is to only spend money on essentials, like groceries and rent, for as long as possible. This is obviously not sustainable, and what happens after is the important part. Let's say you go a month mired in misery, avoiding all non-essential purchases. There's a good chance that once you stop the challenge and start spending more freely again, you're going to end up spending more than you otherwise would. The net result: A month of sadness and nothing to show for it.

If you have kids, God help you if you think you can avoid take-out for an entire month.

Of all the books about how to save money, there's only one that's truly worth your time. You'll be surprised to learn that this book was written nearly 100 years ago in 1926, and the fictional events portrayed in the book take place thousands of years ago in ancient Babylon. Saving money has always been hard — it's human nature.

The book is The Richest Man in Babylon by George S. Clason. There are no intricate systems, no mention of budgets. Instead, this book lays out simple, powerful lessons that will change your life if you let them.

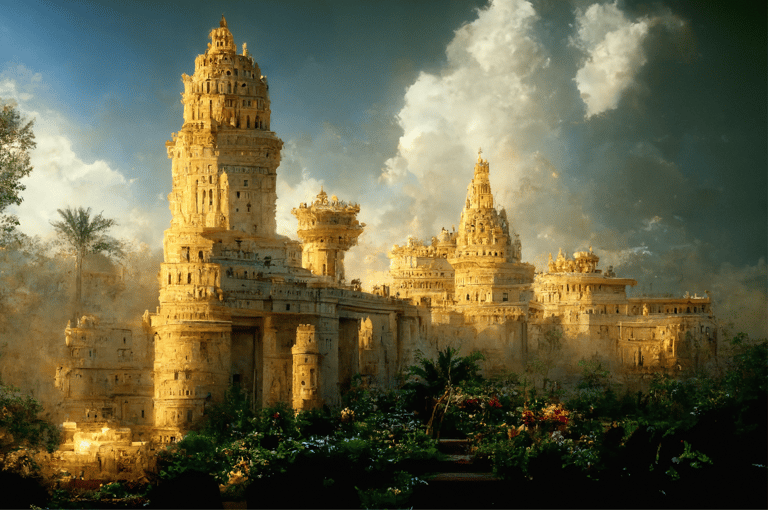

The Richest Man in Babylon contains a series of stories that take place in ancient Babylon, estimated to be the largest city in the world at its peak. Babylon's wealth was unmatched, yet many of its residents still struggled to make ends meet. The difference between those who struggled and those who successfully amassed wealth came down to following a few simple rules.

The big one is this: Save at least 10% of what you earn. If you don't, you'll find that things you consider necessary expenses will grow to consume your entire income.

Here's my suggestion: Make that saving automatic and forget that 10% even exists. If you get $2,000 deposited into your bank account every two weeks, have $200 diverted somewhere else and treat the remaining $1,800 as your take-home pay. For some people, this may not be doable. But many people can make this work, and they'll find that it doesn't really feel much different than saving nothing.

There are many other important lessons in The Richest Man in Babylon. Don't make investments that seem too good to be true. Make sure your home is a profitable investment. Always work to improve your earnings. But ultimately, successfully and consistently saving money is the key.

It's hard to do this book justice in a few hundred words. If you've struggled to save money in the past, try giving The Richest Man in Babylon a read. You might find that the book's lessons resonate with you more than any of the mainstream personal finance books.

If you want to take control of your finances and get a handle on where your money goes each month, Latwy offers a free 30-day trial.