How to Reduce Car Expenses: 11 Tips for Frugal Vehicle Owners

Your car is killing your budget. Here's to stop it in its tracks.

Are you feeling the pinch of car payments these days? You’re definitely not alone. The average monthly car payment in the U.S. is now $735 for new vehicles, and believe it or not, it’s becoming more common to see monthly car payments over $1000. Yikes! If you're looking to cut down on these hefty expenses, you've come to the right place.

Breaking Down Those Annoying Car Expenses

Before diving into saving strategies, let's break down where all that money is going:

- Car Payments: This is the biggie. Whether you’re financing or leasing, a large chunk of your budget is probably going to this.

- Insurance: Can't dodge this one either. Insurance is crucial, but it can also be surprisingly costly.

- Registration: Registration costs vary by state, but in some places, it can add up to hundreds of dollars per year.

- Gas: Fuel prices can fluctuate, but you can't avoid filling up the tank.

- Routine Maintenance: Oil changes, tire rotations, and the list goes on. These small but necessary tasks add up.

- Unexpected Repairs: These are the budget busters. No one plans for a transmission to die or the brakes to fail, but it happens.

With all these expenses, it’s no wonder driving can become a financial headache. But, we’re just getting started.

The Non-Monetary Costs of Driving

Sure, driving has clear financial costs, but what about the non-monetary ones? Yep, they’re significant too.

- Increased Stress: Traffic jams, road rage, finding parking—driving can be a major source of stress.

- Sedentary Lifestyle: More time in the car means less time moving your body, which isn't great for your health.

- Risk of Major Injury: Accidents happen, and the risk is always there. A minor fender-bender can shake you up, but a major accident can be life-altering.

Alright, onto the good stuff—how to save.

11 Tips for Reducing Car Expenses

1. Buy a Fuel-Efficient Car

Looking to buy? Opt for a car that sips gas rather than guzzles it. Think hybrids or even electric vehicles. The less you spend at the pump, the more you'll save in the long run.

2. Shop Around for Insurance

Don’t just renew your current policy without shopping around. Insurance rates can vary wildly. Compare quotes and make sure you're getting the best deal for your coverage needs.

3. Drive Less, Walk More

Simple, right? Whenever possible, ditch the car for short trips. Walking is great for your health and absolutely free.

4. Combine Trips

Instead of making multiple trips, combine errands into one outing. Need groceries and to drop off dry cleaning? Do it in one go. Less driving means less gas used and less wear and tear on your car.

5. Keep Tires Inflated

Under-inflated tires can lead to lower fuel efficiency. Check your tire pressure regularly and keep it at the recommended level. It’s a small thing that can make a big difference.

6. Follow Routine Maintenance Schedule

It might seem counterintuitive to spend money to save money, but keeping up with routine maintenance can prevent costly repairs down the line. Think of it as a little investment for future savings.

7. Drive Smoothly

Rapid acceleration and hard braking can eat up fuel. Drive smoothly, and you'll increase fuel efficiency and reduce the general wear on your vehicle.

8. Carpool

Got colleagues who live nearby? Consider carpooling. It's a win-win: less gas money for everyone and a smaller carbon footprint.

9. Avoid Expensive Repairs by Fixing Minor Issues Early

A tiny chip in the windshield can turn into a huge crack. A weird noise might mean a small part needs replacing. Don’t let minor issues snowball into major repairs.

10. Use Discounts and Coupons for Services

Keep an eye out for discounts on routine services. Oil change coupons and deals on tire rotations are everywhere if you look.

11. Ditch the Car and Ride a Bike

Okay, this one might not be for everyone, but if you live in a bike-friendly area, consider it. It’s the ultimate saving hack. E-bikes make it even easier! While cars are powered by dirty fuels, bikes are powered by the human spirit! Plus, you’ll get some exercise, reduce stress, and slash your car expenses down to zero.

Conclusion

Navigating car expenses can feel daunting, but with these tips, you can cut costs and maybe even enjoy your ride a bit more. Remember, every little bit helps, and before you know it, those savings will add up. Happy driving—or biking!

Do you know where your money goes?

Most people don't even realize they're overspending on thier car because they have no idea where they're money is going. It's not thier fault — the cost of everything is going up, and it's easy to lose track of subscriptions and recurring expenses.

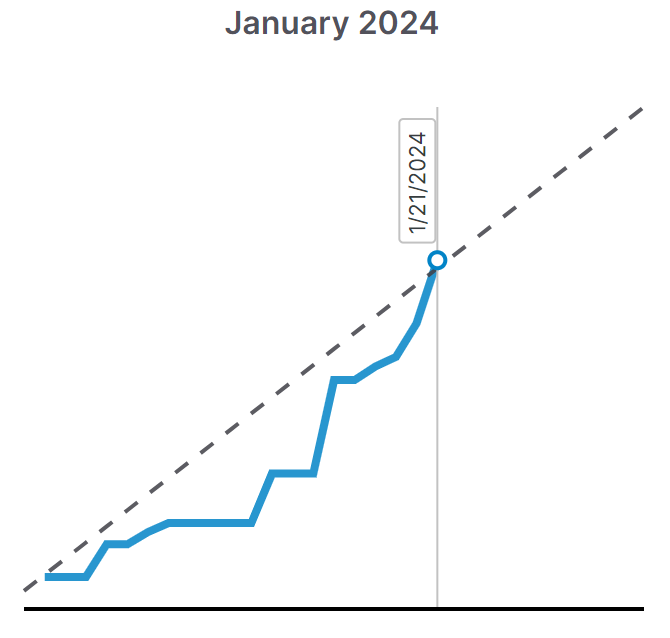

If you've struggled with keeping tabs on your spending in the past, Latwy might be the perfect solution. Real-time alerts, delivered seconds after swiping your card via email, Telegram, Discord, or Slack, can help you get a handle on where your money goes each month.

You can try Latwy free for 30 days with no credit card required. Discover the benefits of Latwy.