The Ultimate Guide to Cutting Subscription Costs and Saving Money

It's easy to lose track of subscription services. Here's how to rein in your spending.

Ever felt like you're drowning in subscriptions? You're not alone! With the sheer number of subscription services popping up, it’s incredibly easy to lose track of how much you're actually spending. Netflix, Disney+, Spotify, Amazon Prime—the list goes on and on. Each one seems affordable on its own, but they can add up faster than you can say “monthly recurring charge.”

Take Stock of Your Subscriptions

First things first, we need to know what we’re working with. Time for a little subscription inventory! Grab a coffee, sit down with your bank statements, and start noting every single subscription you're paying for. Trust me, it's worth the effort. If you use Latwy, tracking down those subscriptions is a piece of cake.

How to Track Your Subscriptions

- Check Your Bank Statements: This might seem old-school, but there's nothing like a good ol' bank statement to reveal all those sneaky subscriptions.

- Use Latwy: Latwy makes it easy to automatically tag and categorize purchases, so subscriptions won't get lost in the void.

- Email Search: Try searching your email for keywords like "subscription," "receipt," or "trial." You'd be surprised at what turns up!

Once you have your list, ask yourself a few questions: Do I really use this service? Could I live without it? Often, services we subscribed to on a whim stick around far longer than needed.

Do You Really Need That Software?

Alright, let's talk software subscriptions like Microsoft 365 and Dropbox. These tools are super useful, but do you really need them? Maybe yes, maybe no.

Microsoft 365

Do you use all those Office apps enough to justify the cost? There are plenty of free alternatives out there like Google Docs, Sheets, and Slides, which cover most basic needs. If you're a student or work in an industry that requires Microsoft Office, you might even get a discount through your school or employer. Definitely check that out before shelling out the full price.

Dropbox

Dropbox is fantastic for cloud storage, but it’s not the only fish in the sea. Google Drive, OneDrive, and iCloud can often do the same job, sometimes for free or at a lower cost. These alternatives integrate well with other services you might already be using, making the switch pretty painless.

Money-Saving Tips

Now, let's get into the nitty-gritty of saving you some cash.

Downgrade Your Plans

Sure, the premium plan offers all the bells and whistles, but do you really need all that? Downgrade to a basic or standard plan where possible. You'd be amazed at how much you can save with basically zero impact on your day-to-day life.

Share Subscriptions

Many services like Spotify and Netflix offer family plans. So why not buddy up with a friend or family member and split the cost? Just make sure you trust each other because no one likes a subscription moocher! Some services have started to crack down on sharing subscriptions, so your mileage may vary.

Cancel Underused Services

Remember those questions from earlier? If the answer is no to "Do I really use this service?" then it’s time to hit the cancel button. A lot of subscriptions can be paused or canceled and reactivated later if you realize you can't live without them.

Look for Discounts

Sometimes, all you need to do is ask. Contact customer service and see if they can offer you a better deal. You'd be surprised at how many companies are willing to give you a discount rather than lose you as a customer. Some services are also available in bundles, although this only makes sense if you need all the services included.

Conclusion

Cutting subscription costs doesn’t have to be a painful process. With a little effort and some savvy decision-making, you can trim down the fat and keep more of your hard-earned money. So go ahead, take stock of those subscriptions, evaluate your needs, and make those cuts.

Do you know where your money goes?

Most people don't even realize they're overspending on thier subscription services because they have no idea where they're money is going. It's not thier fault — the cost of everything is going up, and it's easy to lose track of subscriptions and recurring expenses.

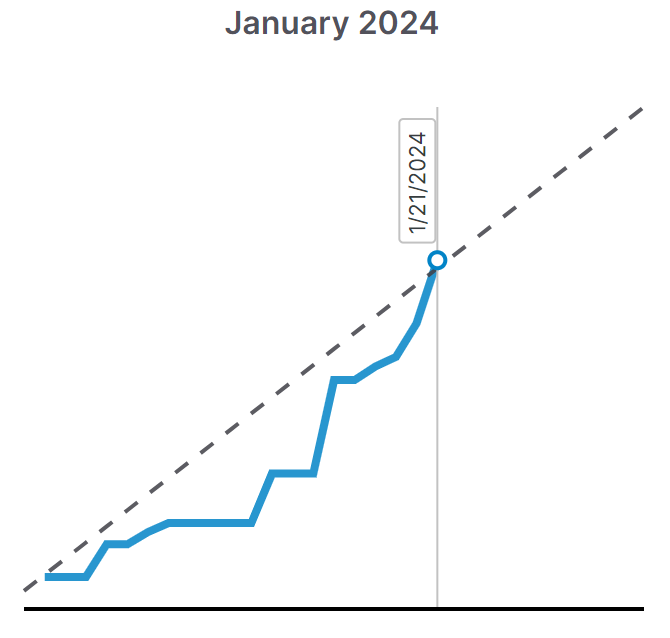

If you've struggled with keeping tabs on your spending in the past, Latwy might be the perfect solution. Real-time alerts, delivered seconds after swiping your card via email, Telegram, Discord, or Slack, can help you get a handle on where your money goes each month.

You can try Latwy free for 30 days with no credit card required. Discover the benefits of Latwy.